The impact of community currencies in low-income communities

Let a thousand currencies bloom - Bernard Lietaer

In 2012, I was part of a Youth Innovation Showcase where I presented an idea of a platform called Commune. One of the 3 focus areas of the platform was on stimulating local economies via cash mobs:

Excerpt of my pitch at a 2012 Youth Innovation Showcase

Needless to say, that idea and platform didn’t have an opportunity to fully materialize as I had hoped. I was bitten by the Cyber Security bug and developed new interests.

Since then, one idea had unexpectedly captured my attention - community currencies. Till then, I had only known the 180 world currencies as recognized by the United Nations.

But reading the works of Bernard Lietaer and others like Thomas H. Greco spoke volumes on this. I particularly liked Lietaers’ focus on local economic development with these complementary community currencies.

These “slum economies” or community currencies are complementary mediums of exchange to a national currency and serve a particular purpose - stimulating local economies during times of business downturns and help provide for basic needs when the national currency is in short supply.

In his 2001 paper, The Economics of Community Currencies: A Theoretical Perspective, Shraven sates: “when the national money fails to facilitate all potential exchanges of a sub-set of the economy that has strong economic interconnections, a complementary currency can alleviate this problem”

By then, I was already aware of Bitcoin, but it wasn’t until much later that I began to think of Bitcoin as a form of community currency (more on this in a follow up article).

In The Future of Money, Lietaers provides a few examples of such complementary community currencies:

Time Dollars - invented by a prominent Washington lawyer and applied in several hundred communities in the US

Ithaca HOURS - a paper currency launched by a community activist in the small university town of Ithaca, New York. Ithaca is a relatively low-income community of about 27,000 inhabitants

Tlaloc - a popular Mexican neighborhood currency

Bia Kud Chum - the first South-East Asian community currency

WIR - an independent complementary currency system in Switzerland that serves businesses in hospitality, construction, manufacturing, retail and professional services.

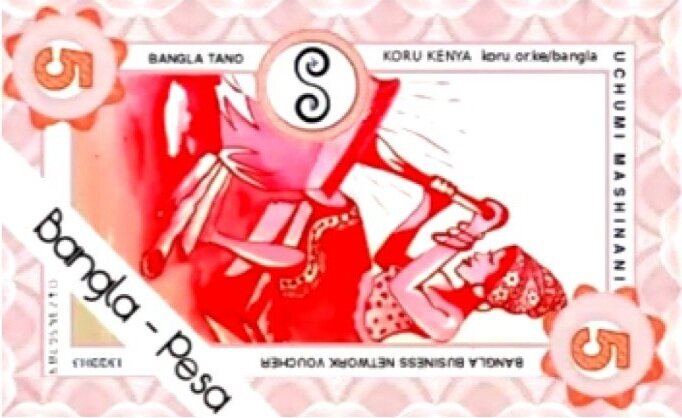

Closer to home, there is one few have heard of Bangla-Pesa - a colorful paper-based complementary community currency used in the slum of Bangladesh in Mombasa, Kenya. It is a voucher that traders and service providers use as a medium of exchange.

Bangla-Pesa community currency

Benefits of community currencies

There exists ample research on the impact of community currencies and how they contribute to sustainable livelihood in poor and informal settlements. It’s worth noting, however, that some community currencies like ithaca Hours, lack clear evidence of economic advantage.

But, some community currencies do show clear evidence of economic advantage.

Below are some examples of these economic benefits of community currencies like Bangla-Pesa:

Daily purchases in Eco-Pesa community currency allow members to save money in their national currency which they would have spent otherwise (these community currencies function as mediums of exchange and are not meant to be stores of value)

83% of business participants reportedly saw an increase in total sales, attributed to Bangla-Pesa

Members have a significantly higher food consumption than non-members, as well as a generally higher food budget

The Bangla-Pesa community currency accounted for 22% increase in monthly income

The Liquidity Problem & Blockchain Solution

There are, however, a few problems with community currencies :

Value generated within the community stays within the community. It cannot be spent within another community

Lack of trust

Scaling and design constraints (typically can’t scale beyond 100 - 200 businesses in the network)

These, among other issues, have been addressed to a degree by incorporating Distributed Ledger Technologies.

A recent paper on this issue stated: of the over 4,000 complementary currencies that have sprung up in 50 countries, most complementary currencies fail to create sustainable monetary alternatives due to low liquidity.

Liquidity is defined as the probability that an asset can be converted into an expected amount of value within an expected amount of time.

Blockchains can provide transparency, audit-ability and liquidity reserves with built-in convertibility between community currencies and promote greater usage and collaboration between communities. Users are empowered to exchange the community currencies for goods and services outside of the originating community as well as between national currencies.

A case in point is the Sarafu Network. Sarafu is a digital community currency and can be used akin to M-Pesa - the renowned Safaricom product.

Sarafu network dashboard

Documentation of the Sarafu Network can be found on their public Gitlab where they cover technical details such as their Smart Contracts, Blockchain choice (POA, xDAI), Wallets, Fiat on-ramps and off-ramps, etc.

Blockchain-based Community currencies

Grassroots Economics, an organization that spear-headed these community currencies in Africa, found that within a 6 months pilot of the Sarafu network:

4,065 Kenyans representing families living below the poverty line traded about $30,000 with each other

Linking 9 community currencies in circulation among 1,136 businesses, clinics and schools

2,567 daily farming wages had been paid

54,928 servings of vegetables

5,361 kilos of flour

2,506 rides on local transport

843 school tuition payments

484,404 liters of water

59 visits to the doctor

Mind-blown!

These aren’t just numbers, these represent healthcare, education, and sustenance for hundreds of families living below the poverty line, without depending on the government issued national currency.

Conclusion

I’m slightly saddened that during my work among marginalized communities years ago, I wasn’t aware of community currencies and focused on using national currencies. Maybe I could have done more. But i’m also over-joyed at the results I have seen over the years of tracking the impact of these community currencies.

Given the above data about the effects of community currencies, there is a case to be made for experimenting and deploying these in informal settlements around the globe. A few initiatives have already embarked on this journey and I hope we will see many more in the coming years.

I’m rooting for the success of all these projects!!